- HOME

- EQUITY

FUNDAMENTAL ANALYSIS

The method of evaluating the balance sheet of an equity

Fundamental Analysis

The fundamental stock analysis method involves the evaluation of a business at a basic financial level. Investors use fundamental analysis to determine whether the current price of a company’s stock reflects the future value of the company. Fundamental analysis uses different factors such as the current economic environment and finances of the company to estimate its stock value. Different key ratios are also used to determine the financial health and understand the true value of a company’s stock. Stock analysis is also called equity analysis or market analysis. Investors or traders make buying or selling decisions based on stock analysis information. Stock analysis helps traders to gain an insight into the economy, stock market, or securities.

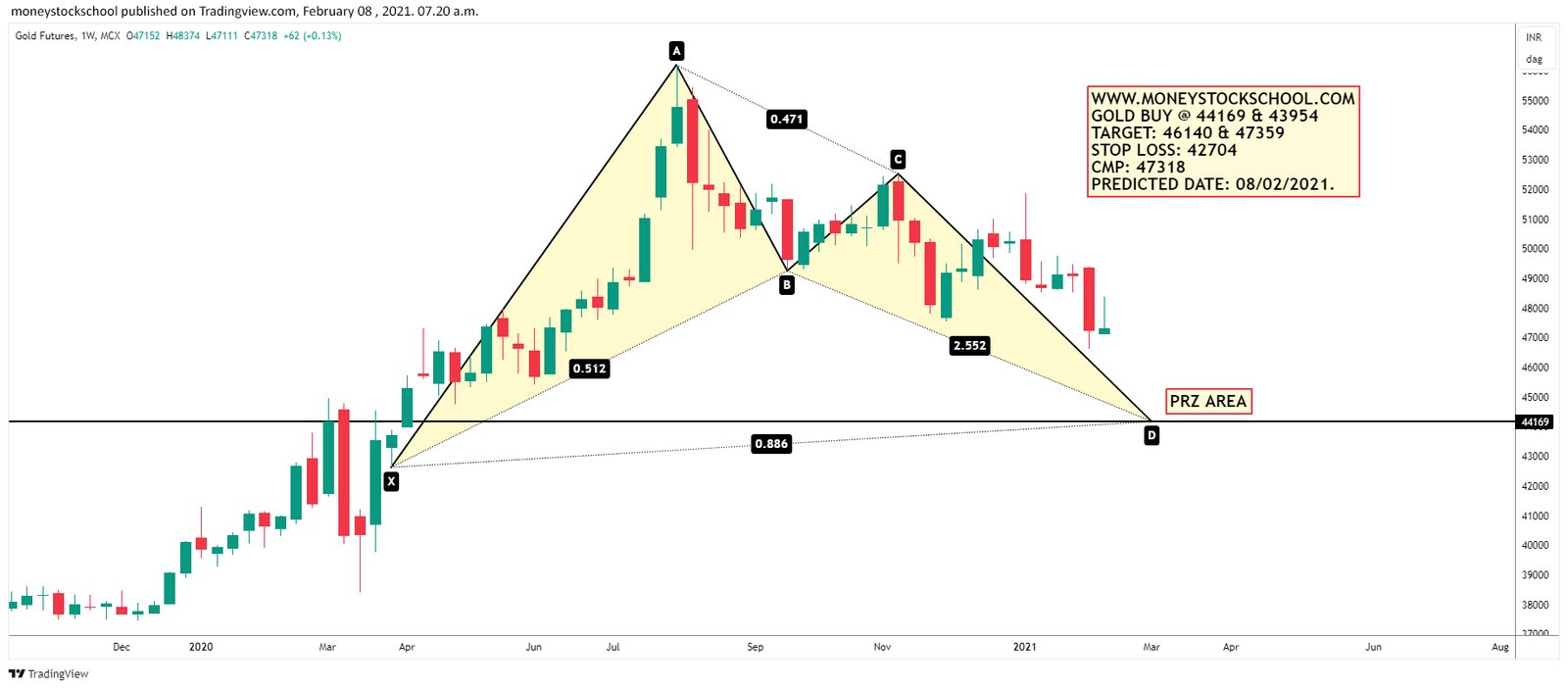

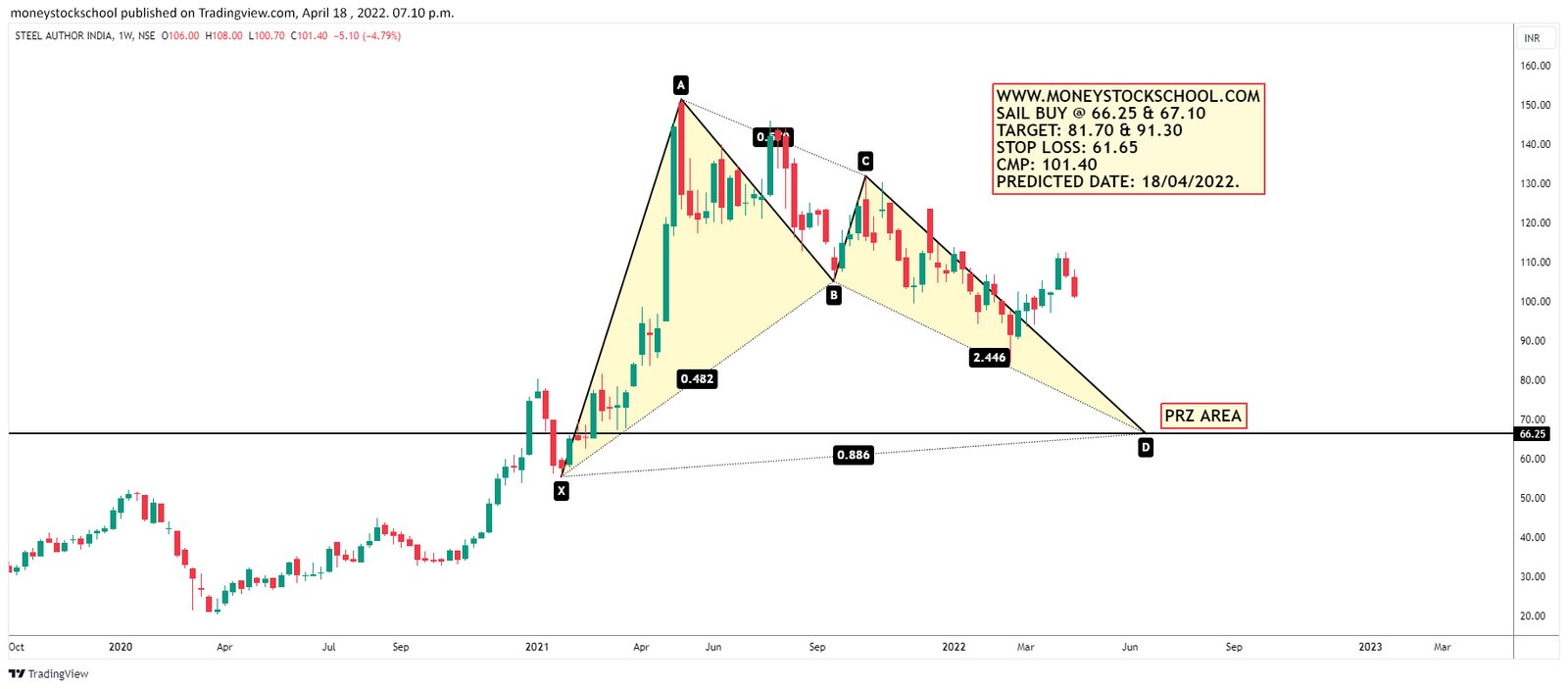

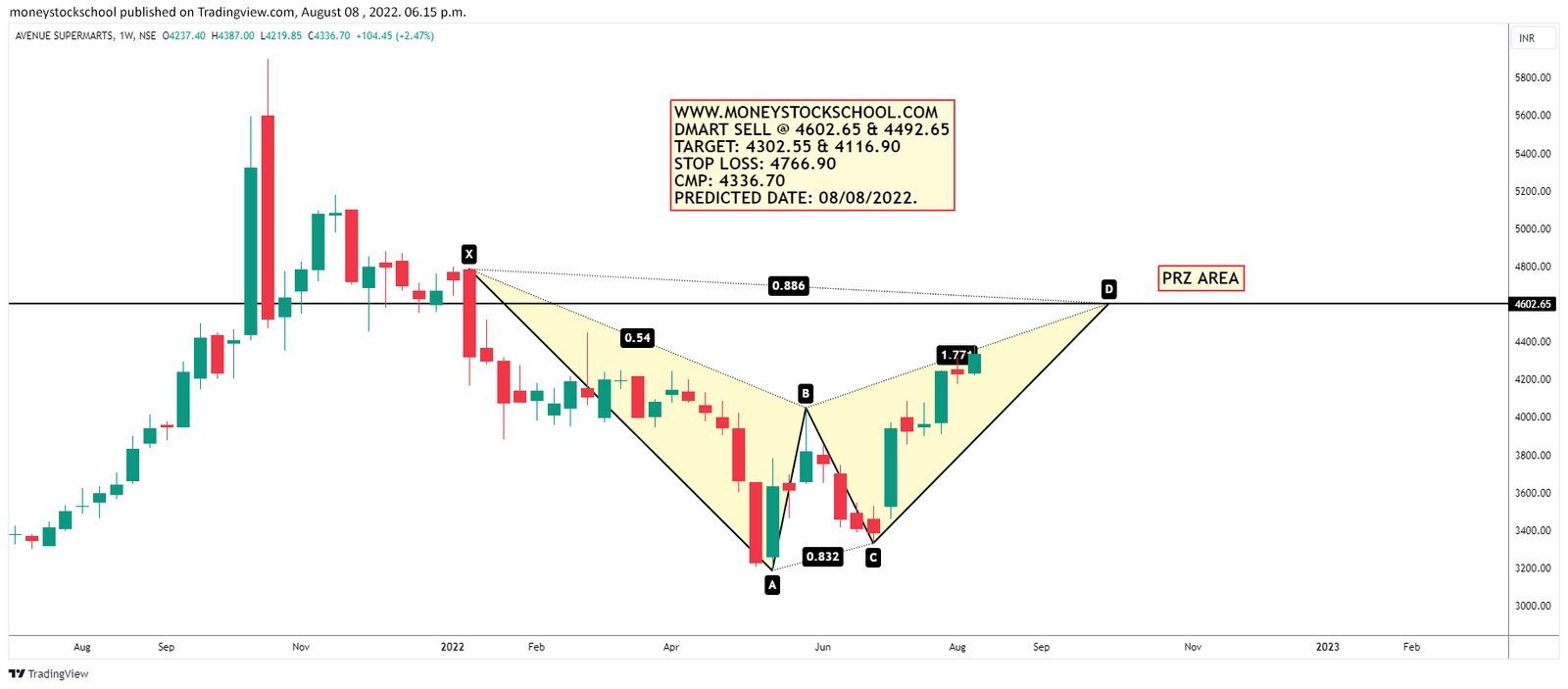

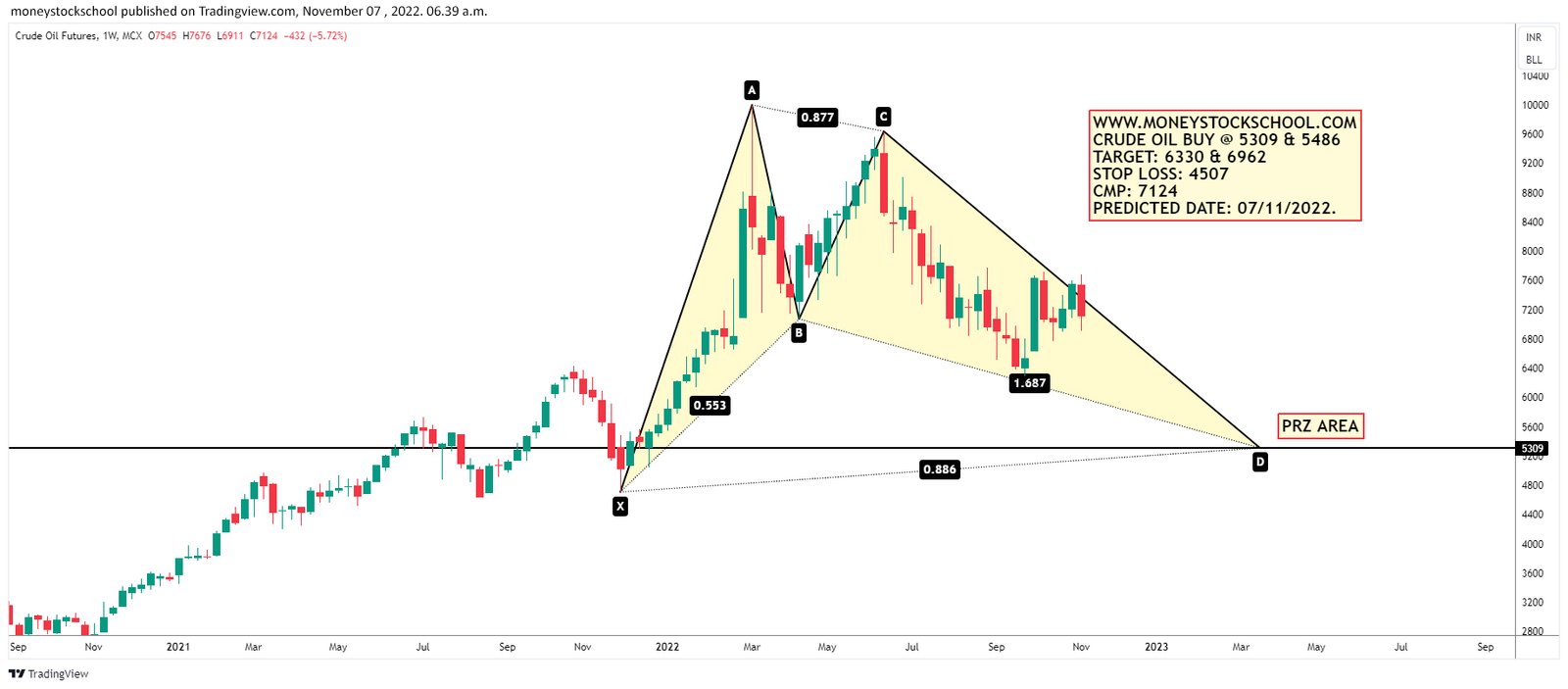

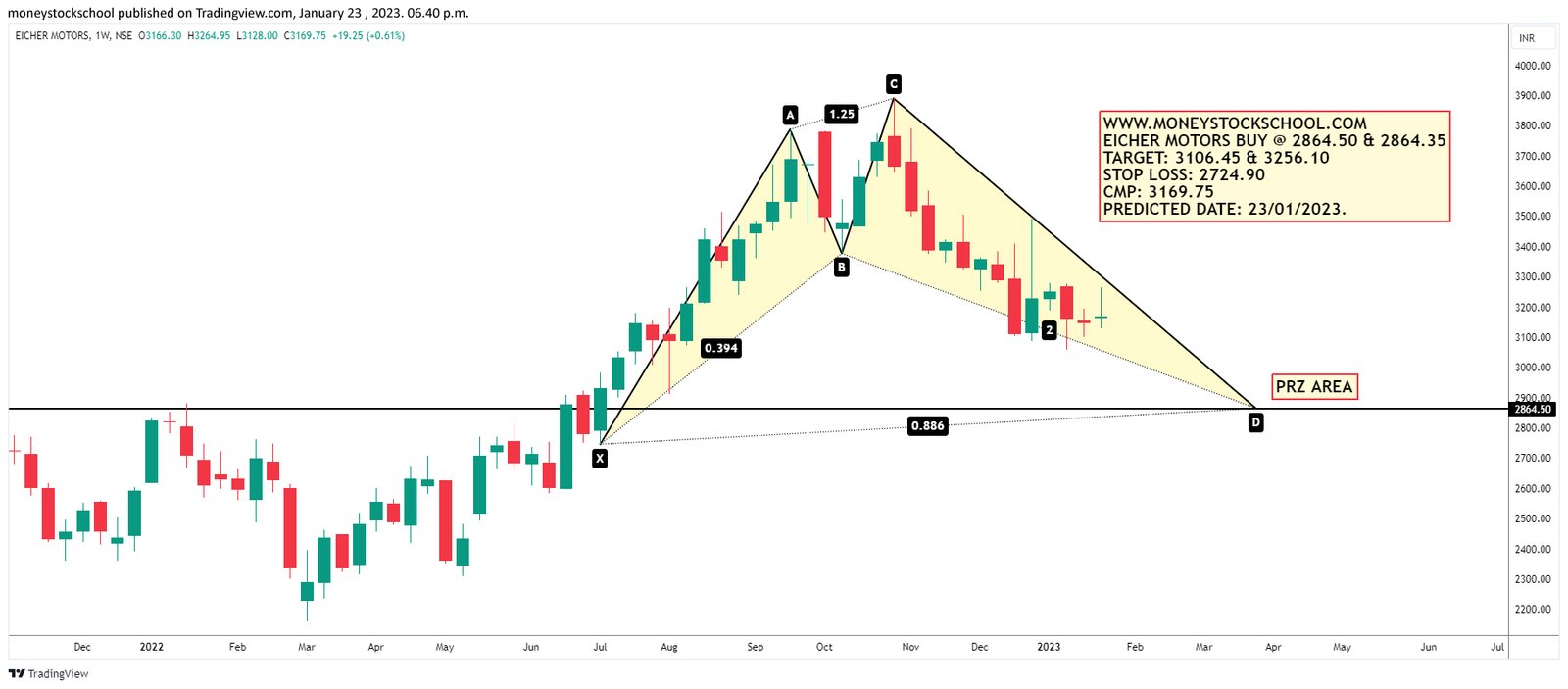

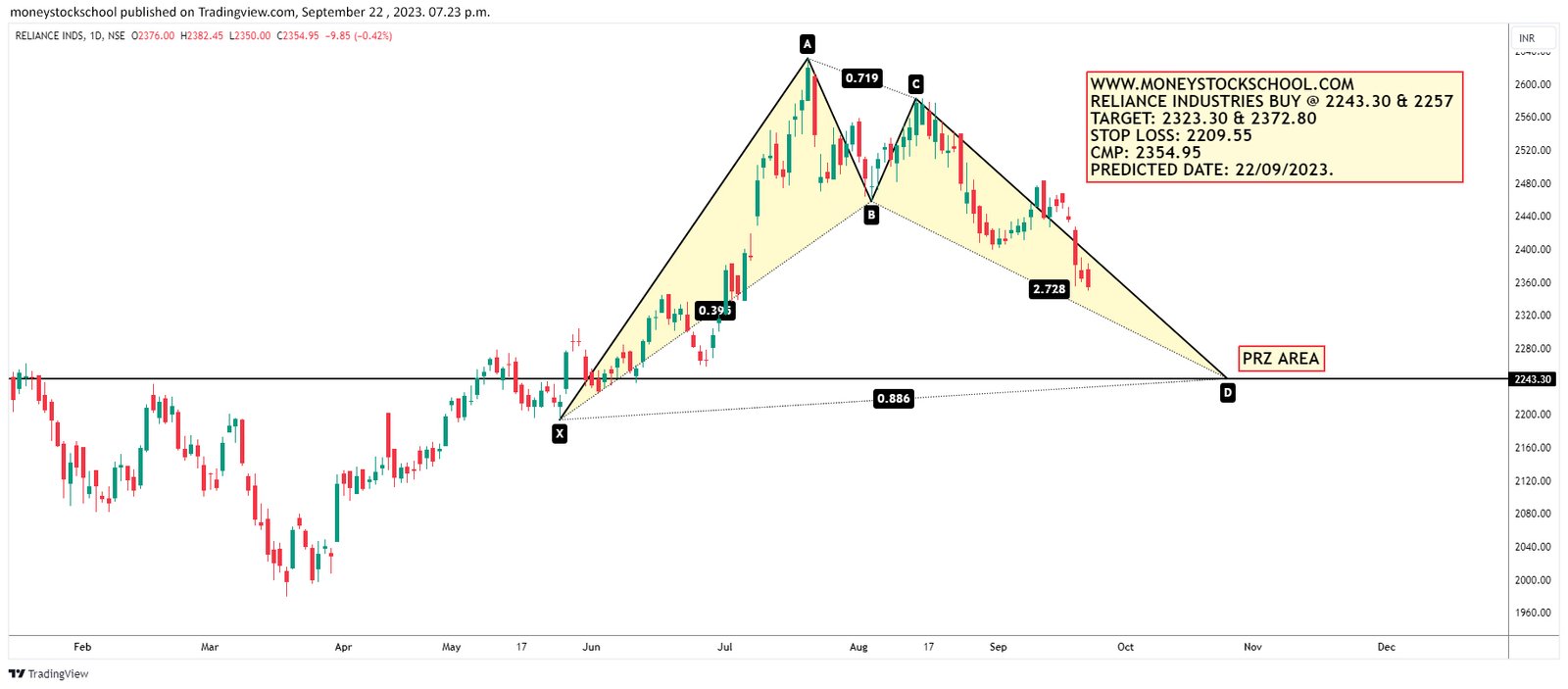

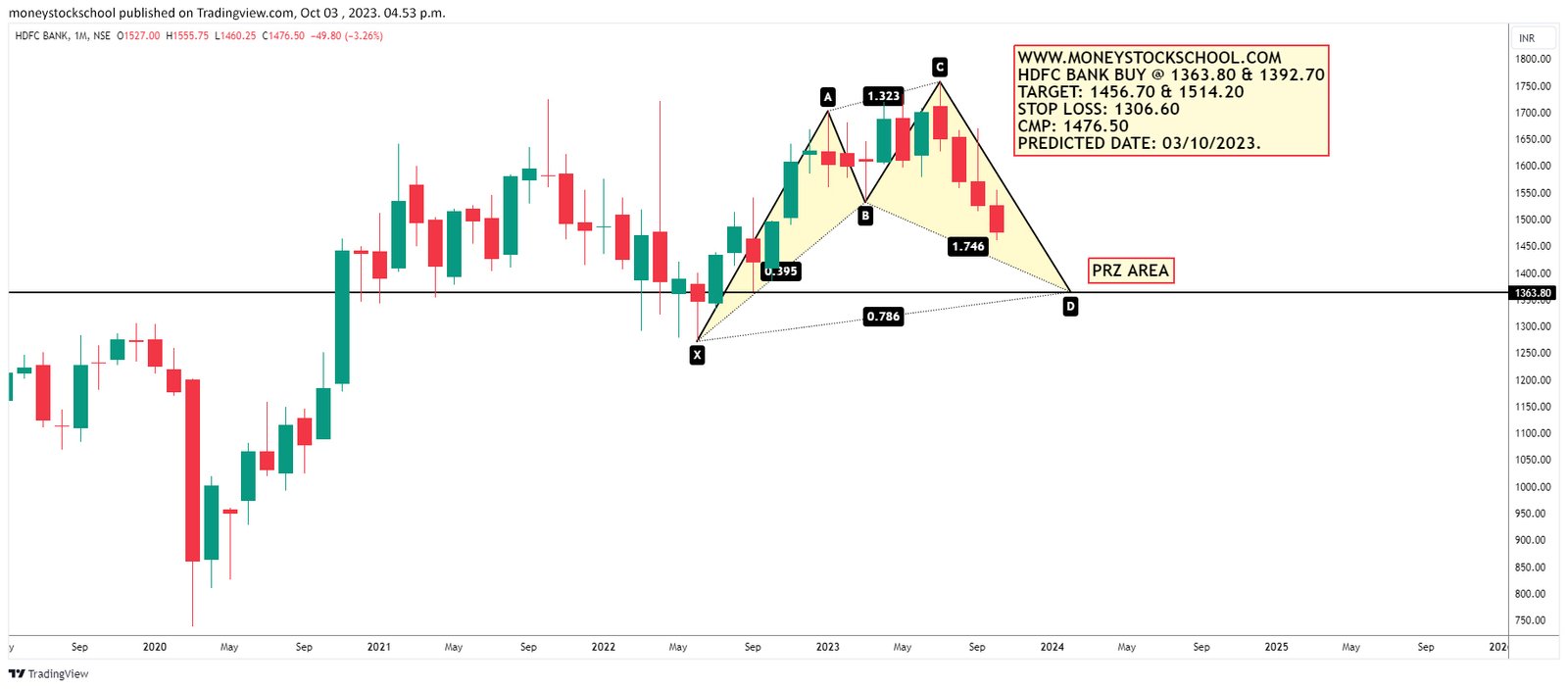

TECHNICAL ANALYSIS

To predict future price movements

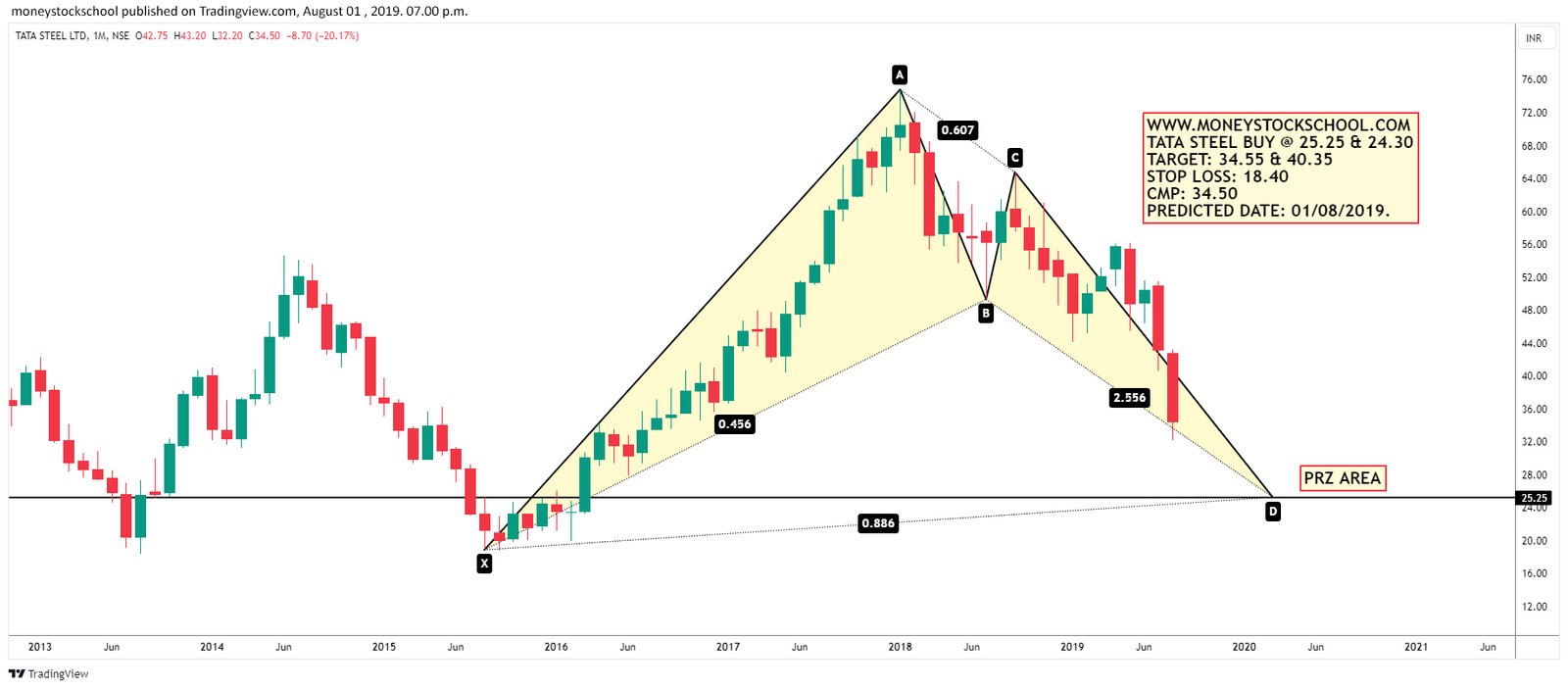

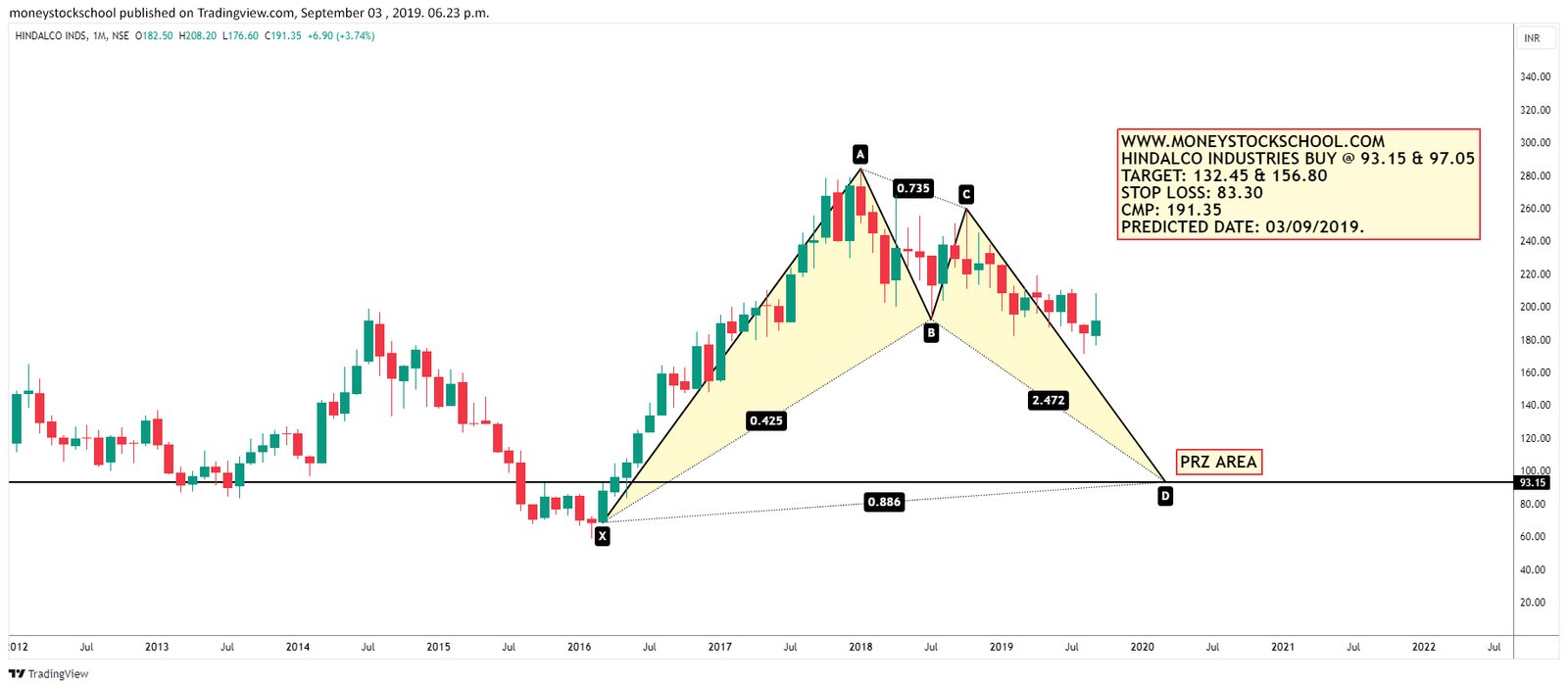

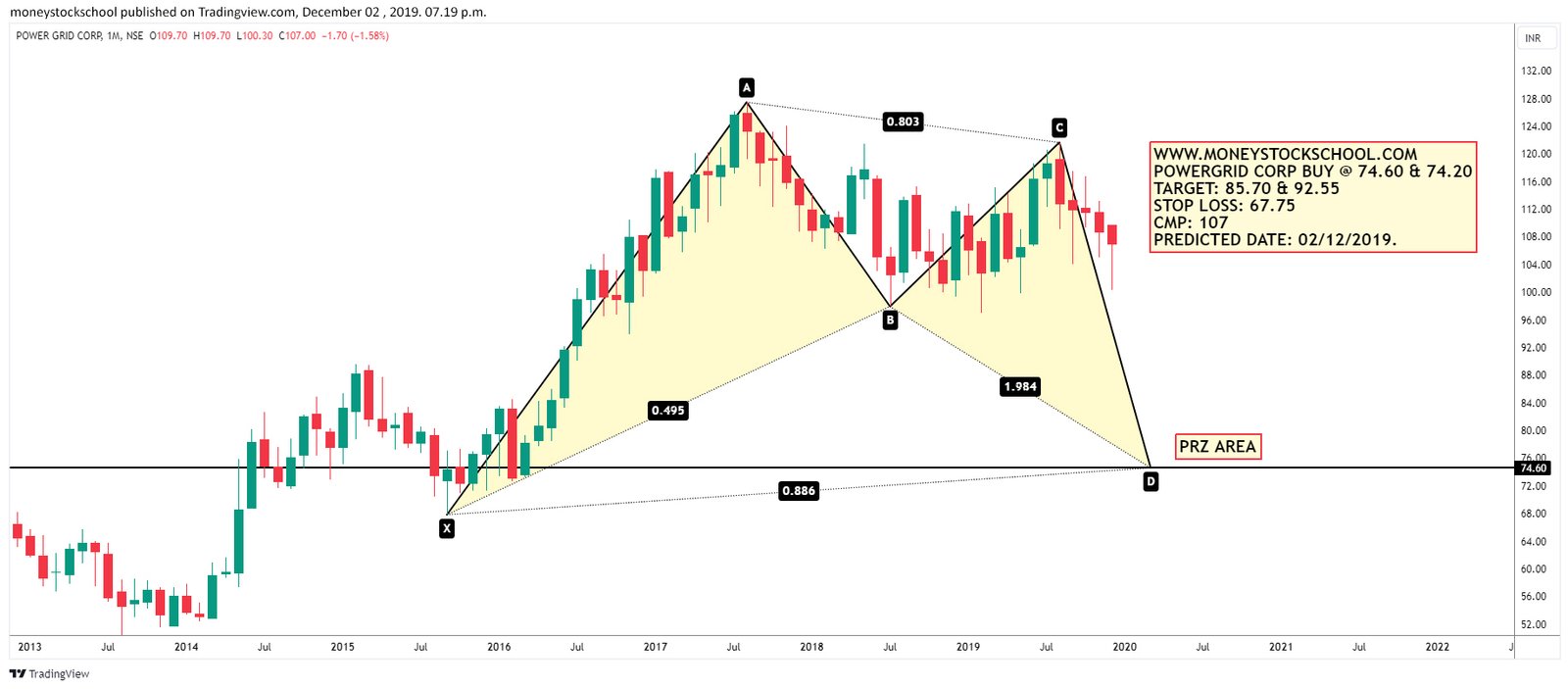

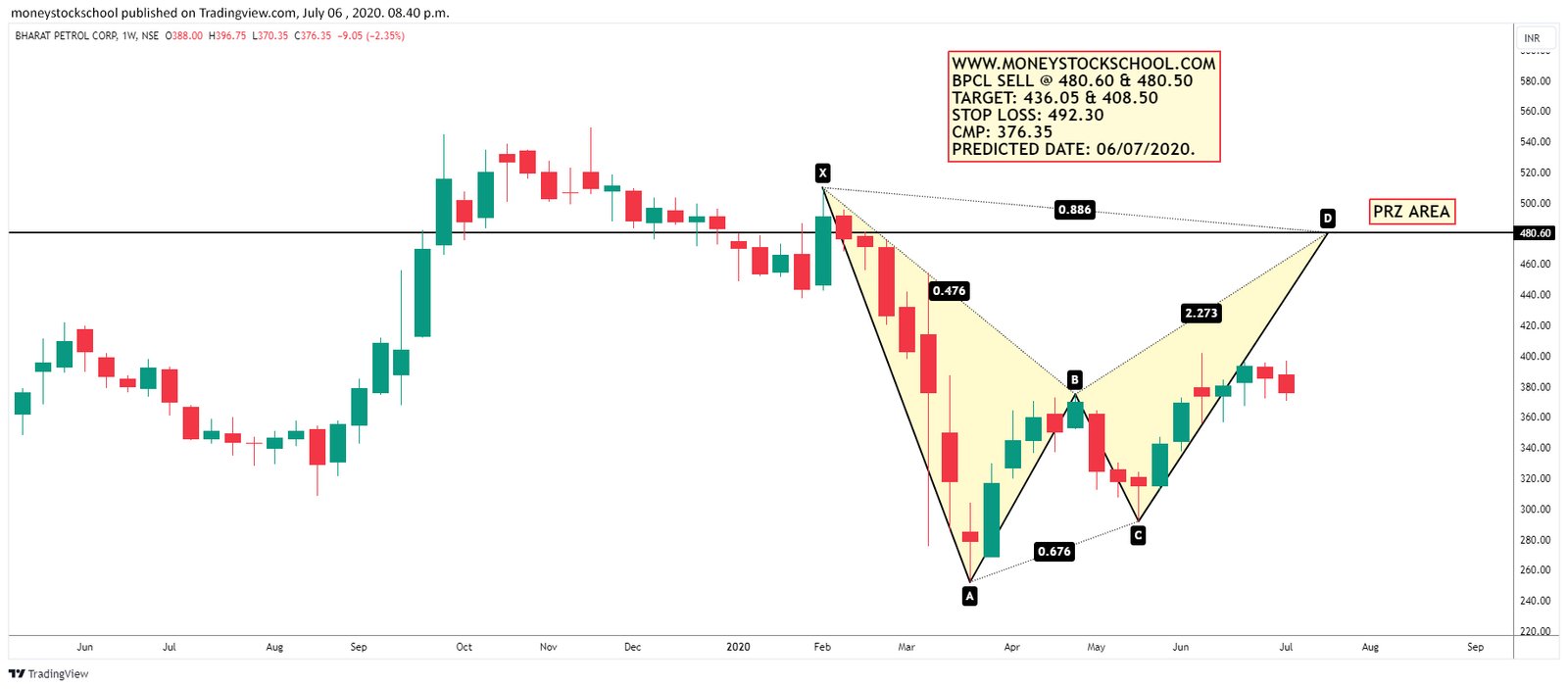

Technical analysts examine the historical trading data of a security and estimate the future move of the security. It is frequently used for forex and commodities. The technical analysis is based on the following assumptions:

The market knows it all

Technical analysis assumes that the market price of a stock reflects all that has or can affect a company. Technical analysts consider that all the factors affecting the company are priced into the security.

Price follows a trend

It implies that once a trend is established, future prices tend to follow the direction of the trend. Such an assumption is the basis of many strategies for technical trading.

History is likely to be repeated

History repeats itself mainly concerning price movement. Market psychology causes price movements to repeat. Technical analysis involves using chart patterns to analyze the movements in the market and study trends. Charts that have been used for over 100 years are still relevant since price movement patterns are often repetitive.